Recently, the Kuala Lumpur High Court in Government of Malaysia v Inoapps Sdn Bhd [2022] MLJU 2280 held that while it was bound by sections 103 and 106 of the Income Tax Act 1967 (“ITA“) to enter a summary judgment against a taxpayer on a civil suit commenced by the Government of Malaysia for outstanding tax assessments, a stay of execution of the summary judgment was warranted on account of the absence of any reason given by the Director General of Inland Revenue (“DGIR“) on the substantial increase in the chargeable income raised against the tax payer vide the assessments. The stay was pending the outcome of an appeal before the Special Commissioner of Income Tax (“SCIT“) on the correctness of the same assessments.

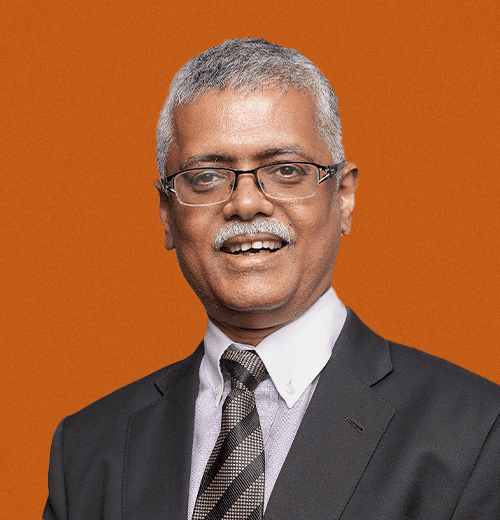

The taxpayer was represented by Christopher & Lee Ong’s Corporate and Commercial Disputes Partners, John Mathew and HK Niak.

This Update highlights the main arguments advanced by both parties and the impact of this decision.

For more information, click here to read the full Legal Update.